Crude Oil Technical Analysis September 28, 2018

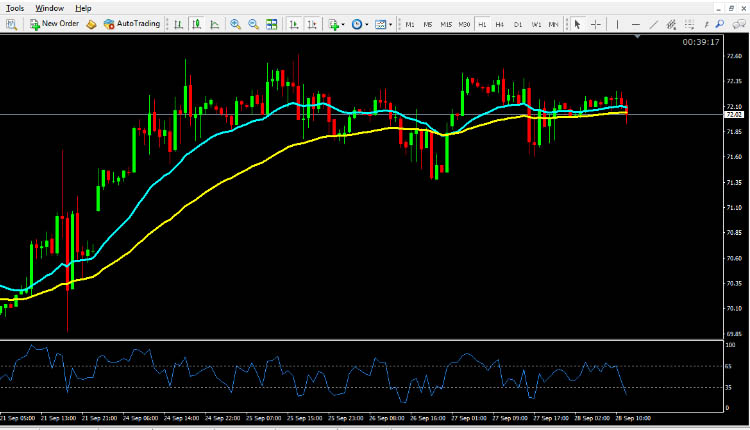

The Crude Oil rose 0.23% against the USD on Thursday and closed at 72.08. Today in the European session while Crude Oil technical analysis September 28, 2018 is preparing at 10:45 GMT, the Crude Oil trading at 72.05, which is 0.4% lower from Yesterday’s close.

After Saudi Arabia announced an increase in production that led to investor sentiment, WTI’s recovery lost momentum below the 72.50 mark. US sanctions against Iran, the third largest producer of the Organization of Petroleum Exporting Countries, were launched on November 4, and Washington asked Iranian oil buyers to cut imports to zero, forcing Tehran to negotiate a new nuclear deal and curb its influence in the Middle East.

Saudi Arabia is expected to add additional oil to the market in the coming months to offset the decline in Iranian production.

Crude Oil technical analysis September 28 2018

The pair is expected to find support at 71.64 and a fall through could take it to the next support level of 71.20. The pair is expected to find its first resistance at 72.50, and a rise through could take it to the next resistance level of 72.90. For today the expected trading range is between 71.20, Support and 72.90 Resistance.

The expected trend for today is Bullish

Supports Levels: Support 1: 71.64 Support 2: 71.20 Support 3: 70.78

Resistance Levels: Resistance 1: 72.50 Resistance 2: 72.90 Resistance 3: 73.36

Previous day`s high: 72.47

Previous day`s low: 71.61

Crude Oil Buying Opportunity for Intraday Trading September 28, 2018

Buy near the support area 71.64 and 71.20 as soon as you get reversal candlesticks patterns like Hammer, Bullish Englufing, Long Leged Doji or Dragonfly Doji, using stop loss 2 pips below the reversal candlestick & keep target equal to stop loss.

Crude Oil Selling Opportunity for Intraday Trading September 28, 2018

Sell near the resistance area 72.50 and 72.90 as soon as you get reversal candlesticks patterns like Shooting Star, Bearish Englufing, Long Leged Doji or Gravestone Doji, using stop loss 2 pips above the reversal candlestick & keep target equal to stop loss.